When I worked in literary management, our writer clients would call me looking for tax advice. “What can I write off as an expense?” and “Can I write off my rent if I work from home?”

I loved most of the clients. These were amazing people, who cracked the code on getting paid to write books. Unfortunately, in most cases, their personal finance acumen was inversely proportional to their writing talent — the most talented were the most financially illiterate.

I think they assumed that because I was a millennial, I’d know more about this “TurboTax” thing. But back then, I was the last person you’d ask for tax advice.

First, as a Hollywood assistant who waited tables on the weekends, I made just enough money to survive . Second, I struggled with the 1040EZ. I couldn’t figure out TurboTax.

Also, the year previous, instead of a refund, I discovered that I owed the IRS $10,000.

My $10,000 tax mistake

It was two days before the filing deadline, and I was sitting in an H&R Block squirming in the Ikea chair.

“Did you have any business expenses?” the accountant asked. “Did you buy any business cards? Any office supplies? Do any printing?”

She was trying to help. She was trying to find enough itemized deductions to get me over the standard deduction…

Except I couldn’t conjure up more than $5,500 worth of deductions in 10 minutes.

I had no choice but to pay the taxes owed in one lump sum: around $10,000.

It had been a rough year. I’d been freelancing and picking up a number of side gigs to keep myself afloat. I worked as a casting assistant, a production coordinator, and a script reader while writing and studying marketing and entertainment. I got caught up in that millennial dilemma of finding side hustles, then doing the work. I never stopped to think about something like estimated taxes.

For example, no one told me to set aside a third of my income to cover taxes at the end of the year. The IRS bill blindsided me.

I remember stepping out of the dumpy H&R Block building on Sepulveda, kicking stones on the pothole-ridden parking lot. I was frustrated with the accountant and frustrated with the whole H&R Block experience.

Mostly though, I remember how shitty it felt to be barely scraping by in Los Angeles, uneducated and misinformed about protecting the business of me.

Crossing the lot to my car, I promised I’d never be in that situation again.

A 7-year playbook on taxes

Every year, come tax season, I started collecting notes. Slowly, painfully, becoming more informed. Imagine the opposite of Tim Ferriss’s accelerated learning — that was me learning about taxes.

Each year, I learned something new. Even if I went to a tax professional to file the taxes (which I do, and you should too, because as outlined above, this isn’t tax advice and I’m not an expert), I wanted to walk in informed.

After a few years, I put together a pretty good tax playbook for millennials working in Hollywood for the first time.

However, there’s always more to learn. Yes, figuring out your taxes sucks when you’re freelancing and you have no money. Turns out, it’s still not fun when you’re employed and making good money.

For example, the tax reform bill that passed in December 2017 changes the game. The standard deduction is doubling, so you may not need to itemize your deductions anymore. Whatever the case, you have to continue to adjust and build on your foundation of knowledge, because this is never going away.

How to find a great accountant

After the H&R Block fiasco, I decided to do three things:

- Start early

- Hire a professional

- Find an accountant I liked

I started asking everyone I knew, “Who’s your accountant, how long have you used them, how was the experience?” I asked people who worked in entertainment, teachers, doctors, older and younger persons. It didn’t make great conversation fodder at cocktail parties, but other than that, it was great.

After a few weeks, I settled on an accountant who worked out of a small Culver City office inside a strip mall. A place I never would would have stumbled upon on my own. My friend (who was the assistant I sat next to) said “Go see this guy. He’s been doing my taxes for years.”

She was right. This accountant was neat and professional. He answered all my questions. He made the process ridiculously painless. I gladly paid his fee, just for the peace of mind that my taxes were filed, and filed properly. The first year he did my taxes, he got me my first refund since I was 21.

He’s done my taxes ever since.

I strongly believe that everyone should go to a professional. You don’t just pay for their knowledge, you pay for peace of mind. If this isn’t your field of expertise, let the professionals do it, ask a ton of questions, and start building your own playbook.

It can take some work to find the right person. If you’re not satisfied with the recommendations, keep asking around. Keep asking friends and colleagues. Jump onto a Reddit or Facebook group you’re active in and ask who they use.

Pick your method to track expenses

Before we get to the list of deductions you can take, you need a record keeping system.

An encyclopedic knowledge of all the deductions in the world won’t matter if you keep shit records. This is especially true if you’re freelancing, paying self-employment tax, and taking deductions, because there’s a higher probability the IRS will take an interest in your returns.

If you tell the IRS you owe X dollars, and they think you owe Y, you better prove it. They may not audit you this year, or the year after that, but they have the right to audit your return within 3 years of filing.

If that ever happens, you need to show how you got your numbers.

Some people are more predisposed to keeping amazing records than others. You may not be one of those people, which is fine. There are two ways to do this: the precise (hard) way and the automatic (easy) way.

First, the hard way (this is how I started):

You need to track receipts for the purchases you want to deduct for expenses. Keep your receipts in an envelope as you collect them. Once a week, enter all expenses into your spreadsheet (we’ll get to that), then take a photo of the receipt and save the photo.

Once the receipts are digitized (and preferably, backed up to a cloud or external hard drive), you can throw them away.

Do yourself (and your accountant) a favor: no shoeboxes, people. Don’t jam those receipts in there and fork it over to your accountant when it’s about to bust open like a piñata.

I used to keep photos of the receipts in Evernote, where I’d use an “Expense” tag, so with a single click I could pull them all up. However, do whatever works for you.

Now, the easy way:

If you have a bit of proficiency with technology, as most millennials do, do it this way. Instead of tracking and recording individual receipts, I use Mint and email to automatically track my spending. All I do is tag items as “tax” as they come up, and once a month, I pull up all those expenses and add them to a spreadsheet.

Some might find this too tedious to do every month, which is understandable. The only thing I’d say is start before April 1st. Being inside H&R Block a few days before the deadline is not pretty.

While we’re on the topic of tracking things:

- When your employer sends your W-2, scan a copy, then put the hard copy in a folder

- When your banks or brokerage accounts notify you your tax documents are available, save the pdf, then print out a hard copy

- Same with any loan payments you made during the year

- Have last year’s tax return on hand

Tracking expenses, using a spreadsheet, capturing receipts… are these gyrations worth the hassle? That’s completely up to you.

General rule of thumb: if you estimate the sum of your deductions will exceed the standard deduction (for 2017, $6,350 if you’re filing as an individual or $12,700 if you’re filing jointly), then it’s worth it.

If it’s close, you can always take the standard deduction.

If your estimated itemized deductions will definitely not exceed the standard deduction, then no, it’s probably not worth the energy.

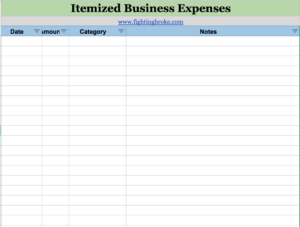

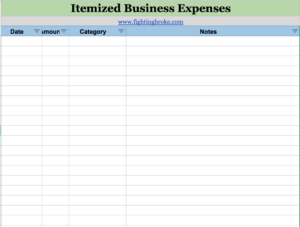

Build your badass spreadsheet

You need a spreadsheet that both tabulates your expenses AND reminds you of common expenses to track.

When I first started, there wasn’t a detailed or specific enough sheet for the entertainment industry, so I built my own.

You can check that out (and save a copy for yourself) here.

At the time, it captured 99 percent of my spending. I formatted it to track spending per month and per category, and the first sheet includes all of the deductions that I’ll cover below.

On the second sheet, you can plug in your expenses as they occur. If you properly label each category, it’s a simple task of using the “filter” to total up the month’s expenses in any category.

Finally, the third spreadsheet tracks mileage, which can be plugged back into the first spreadsheet, so you can calculate your deduction based on miles driven.

Keep what’s useful to you and discard the rest. I’m no longer freelancing, but I have continued to use a version of this spreadsheet ever since.

A big list of deductions you can expense

1. Rent/Mortgage. Do you work out of your home or apartment? If so, a portion of your rent/mortgage can be deducted each month. Calculate what portion to take by measuring the square footage of your office space and dividing it by total square feet. (The IRS requires that your office space be allocated for work only, and is a closed off from the rest of the home apartment.)

2. Utilities (gas, electricity, and Internet). Calculated in the same manner as above.

3. Medical bills. If you spend over $8,000 on medical expenses, you may be able to expense a portion of it.

4. Donations. Many are tax deductible. That includes clothes donated to Goodwill or Salvation Army. Take a photo of what you’re donating, and estimate the fair value of all the goods (how much would you get for selling it on eBay?)

5. Cell phone. If more than half your cell phone use is for business, then you can deduct that proportion, up to the total bill.

6. Insurance (car, renter’s, health). Car and renter’s insurance should be proportionate to how much they’re used for work. The entirety of your health insurance premium can be deducted if you pay it yourself.

7. Office supplies. If it went on your back-to-school list, it counts.

8. Shipping supplies (labels, postage, printer paper, toner)

9. Business Cards

10. Website domain name

11. Web Hosting. If you pay for web hosting with Hostgator, BlueHost, or (hopefully not) GoDaddy, count that as a deduction.

12. Web designs and templates

13. Web/phone apps (Dropbox, WeekendRead, Evernote)

14. Email marketing software (Aweber, MailChimp, InfusionSoft).

15. Computers

16. Printers

17. Cell phones

18. Monitors

19. Networking. If it’s a business drinks or coffee, yes, count this as a deduction.

20. Membership dues. If you’re affiliated with a professional association all dues will count towards your deduction.

21. VA Fees. If you’re using a virtual assistant, deduct their fee.

22. Professional conference fees

23. Meals. Meals can be deducted but the rules are stringent. Typically, only 50% of a meal can be deducted, and it must be a business meal. For example, you’re taking a client out to dinner or lunch, yes you can deduct. If you’re running errands and stop at an In ‘N Out, no, you can’t.

24. Gifts. For colleagues or clients, buy lunches, all charges. See above

25. Job search related costs. Any money spent while trying to find a new job — including taking people to drinks or coffee.

26. Tax preparation services. If you hire a tax professional or use tax preparation software.

27. Financial services. If you use a financial service, you can deduct their fees (I use StashWealth and strongly recommend them)

28. Market losses. If you take a capital loss in the market, you can use that to offset taxable income. If the market was good for the past year, there won’t be many losses to take.

29. Education (classes, books, magazines). If it’s pertinent to your career, you can deduct. Make sure you’re able to justify why it’s pertinent to your work, however.

30. TV/cable, Netflix, Movies. If it can count as research to your work, you can take it.

31. Snacks. If it’s for the office or consumed during your work day, it counts as a deduction.

32. Coffee runs. Same as above.

33. Mileage. Your commute to your office or place of work cannot be deducted. However, mileage for runs, for errands, and other business-related tasks do count. Track miles, not what you pay in gas (you’ll get 56 cents to the mile).

34. Parking. If it’s not part of your commute, deduct it.

35. Taxi/Uber Fares. See above.

Two final things to keep in mind with deductions:

Write-off doesn’t mean free. In conversations with other millennials, I noticed there’s the perception that deductions = free.

Which can make it easy to justify lavish purchases (“I’m going to write it off anyway!”) No. This is not THE FIRM — you can’t write off every trip to the Cayman Islands and your Red Stripe tab and have enough saved over for a new Beamer.

Here’s the math:

When you take deduction X, it reduces your taxable income by X. What you save is X times your rate of tax.

For example, let’s say your taxable income is $40,000. You’re deducting $100 for office supplies in June. You’ll only be taxed for $39,900.

If your current rate of tax is 20%, then the amount saved is $100 times 20%, or $20.

Deductions are a great way to earn money back in the aggregate, but it’s hardly a blank check. Don’t try conning the system or fooling yourself into the idea that you’re saving money by spending money.

You must be able to defend why something counts as a deduction. The IRS has a catch-all category to cover expenses: “necessary and ordinary.” This feels like a free-license to spend whatever, but if you can’t backup, in writing, why it’s “necessary and ordinary,” the IRS may not count it.

I’m always looking to learn more about taxes. Tips? Anything I missed? Let me know.

#####

Photo Credit: 401(K) 2013, Scott Hudson

1 Comment

Hi, Chris! SUCH an awesome and helpful article. Thank you so much. I’m actually in a similar note and having recently moved to LA from NorCal, I must admit I’m dying to know who your accountant is, as I’m a new entrepreneur with two businesses.