This is my friends & family newsletter. I publish here for reference and sharing. You can subscribe here.

⏩️ Updates

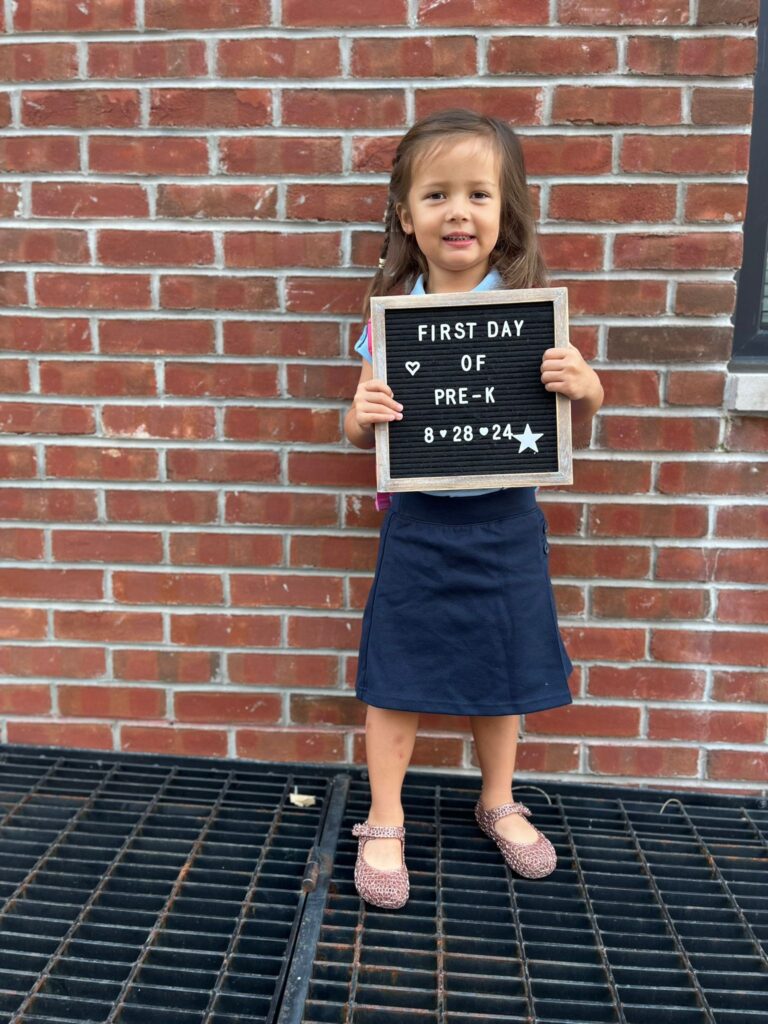

It’s back-to-school season: Oliver started first grade. Annabel sprinted through the doors to Pre-K and hasn’t looked back.

We’re working on getting Theodore into daycare. Once he gets in, we anticipate he’ll spend his first two months at home with a cold. So it goes.

ICYMI, last month I published:

And I’m ramping up the October cohort of my Land A Remote Job program.

What’s new with you? I’d love to hear about it. Hit “reply” or DM me here.

🧠 An Immigrant Mentality

I’m often asked what personal finance books I’d recommend.

I don’t open with this to show off how (incredibly!) financially savvy I am, or humble brag about signal how (very) often people flock to me for advice. I think recommendations require context. Especially when it comes to money.

🥡 The Way It Works

I started waiting tables when I was 14. It was my uncle’s restaurant, at the top of the hill, off the Rensselaer exit in East Greenbush. Today the sign out front reads Asian Tea House. Before that, it was called Yip’s. Most of my family did a tour of duty there: aunts, uncles, my parents and siblings.

I was 17 when I started training my brother, Jon. We taught by shadowing/shadow back. He followed me first, watching as I took orders, refilled glasses, and dropped off checks tucked beneath sugar cookies containing pithy quotes and useful Chinese expressions like “bus station.”

Then I followed him. He covered my station and I stepped in to help with calling out orders in Cantonese or getting tea while he took orders. Later, it got busy, so I assigned him to one table off my station.

Afterward, his customers left him a $5 tip. He was delighted. 2 of those bought you a pork lo mein dinner combo, which included fried rice, egg roll, and soup. 8 bought you a new Playstation game. He started to pocket it when I stopped him.

“You’re still training, so you don’t get tips yet,” I said. I took the bill.

“But I worked that table. You didn’t do anything,” he said.

I didn’t like his tone. “Look, you’ll get your own station soon. I trained for 3 months and never got tips. That’s just how it is.” I thought I was giving him a lesson.

It wasn’t until years later I realized he was giving me one:

Money is not equal.

To me, that was another bill I’d add to my haul for the night.

To him, it was the first dollar he earned. He sweated for it. He fished it off the table, wiped the sauce of it, and imagined what he might buy with it.

Before his older brother took it from him and stashed it away where it immediately became unrecognizable from all the other Abes and Andrews, it meant something to him.

That’s the way it works, I told him.

Which was true.

But it didn’t have to be.

👫Proud To Object

Amy saved up €12,000 before moving to Los Angeles. This was in 2012. At first, she planned on renting her own apartment, in a half-baked plan to feign appearances. We quickly discarded that idea. She was already moving 5,142 miles for us. We might as well go all in.

It took her 18 months to scrape that money together, between summer camp, teaching a correspondence course, and bartending. At first, we thought she was rich. Then we split the security deposit and the first month’s rent. She bought a car (a ’92 Corolla, with a busted AC and a passenger door that didn’t open. But still.) She started commuting 80 miles a day for an unpaid internship. Pretty soon, most of the nut was gone.

We tried slowing the burn. We ate at home a lot. If we did eat out, it was 50% off takeout from the Thai restaurant I worked at, or the $7 carry-out special from Papa John’s. We stopped buying stuff. For Christmas, we gifted everyone homemade coasters made of Scrabble tiles.

We split the rent equally, which seemed “fair” in the unnuanced definition of the word. I was too naive to know better. She was too proud to object.

Fair isn’t one person has 3-years to build a life in LA and the other gets 3 weeks, then splitting things 50/50. Fair isn’t about each person contributing equal parts to the household. Fair isn’t about the count: dishes, diapers, dollars.

What is fair?

It’s contributing meaningfully, to the best of your abilities, as you both work towards a common goal.

Fair is being on the same team.

🫎A Wild Place

The richest day of my life was breaking $100,000 in compensation.

I was 27 years old. I never thought I’d make that kind of money. I only needed to work two full-time to do it. I remember thinking, why would I ever need to make more money than this?

When I told my friend Scott about this, he laughed. “Then you have kids and a family, and you realize that’s not quite true.” He was right.

I have another friend who made a couple of million during the crypto hype train of ‘17. He bought 30 BTC at $300 and a bunch of ETH at $7. He invested in a bunch of ICOs, too. Most of which went to zero. A few, though, yielded somewhere north of a 20x return.

He didn’t get out at the peak. Wasn’t far from it, though.

This friend is the one who gave me my education on start-up equity, FMV and strike prices, and how much money could be made against 5-10x multiples for a Saas business. He opened my eyes to how many levels there were to this money thing.

But to be honest, it still seems fugazi. Made up. Existing only as 0s and 1s, an ephemeral effervescence. That’s an immigrant mentality. If you can’t touch it, if you can’t shove it under a mattress, it doesn’t exist.

The challenge is holding both these ideas simultaneously in your head as truths: 1/ grateful for what you have, and 2/ ambition for more.

That second part is equally important as the first, because while it’s true that money doesn’t solve all problems, it does solve money problems. And there are always money problems, evolving and transmuting like a time-lapse video on the nature channel.

Recessions, workforce reductions, family emergencies, 2am decisions, drink, drugs, calories, terrorists, crashes, disease… we can’t know which we’ll face. However, we can be certain of some combination in our future.

The world is a wild place.

📚 Here are my 4 favorite books to help you navigate the wilderness:

1/ I Will Teach You to Be Rich by Ramit Sethi – My go-to recommendation for someone starting their financial journey. Ramit keeps it real with no-nonsense advice that sets you up for financial success. This is where you learn all the blocking and tackling (e.g. credit cards, getting out of debt, which savings account to open, etc.)

2/ Psychology of Money by Morgan Housel – This book is a perfect follow-up to Ramit’s, diving into why we handle money the way we do. It’s super insightful about the weird ways our brains work when it comes to money and risk, showing you how to make better financial decisions. If IWTYTBR is the block and tackling, then this is the mental game of personal finance.

3/ The Millionaire Fastlane by MJ DeMarco – I didn’t love this the first time I read it. It gave me “Rich Dad Poor Dad” vibes. But on the second and third reads, the ideas here changed how I think about diversifying income sources.

4/ Quit Like A Millionaire by Kristy Shen and Bryce Leung – This one’s got a strong FIRE vibe (Financial Independence, Retire Early), which might not be for everyone’s. But even if retiring early isn’t your goal, it’s packed with straightforward tips on how taxes work with different investments. Useful as you dive deeper into exploring how you want to design an investment portfolio.

⭐ Recommendations: Tipping, Diet Pepsi, Credit Card Rewards, Chess

💁The generosity of strangers — via tips — paid off my student loan, and got me through tough years in LA. So I have conflicted feelings of the pervasiveness of tipping culture today (do I want to tip 25%, 22%, or 18%)? Two podcasts that do a great deep dive on it: Shit You Didn’t Learn At School and The Daily.

✈️ About 80% of our flights to Ireland have been covered with credit card rewards. I think playing the game is worth it — if you play it carefully. Here’s a great breakdown on what that means.

🥤Diet Pepsi by Addison Rae was the song of my Brat summer.

📕 Barbara Kingsolver wrote The Poisonwood Bible, which was nominated for the Pulitzer Prize for fiction. Then she wrote Demon Copperhead, which won the Pulitzer Prize. Both are fantastic. Every other paragraph is poetry.

🔉If Books Could Kill did their takedown of Jonthan Haidt’s The Anxious Generation. Strong recommend, especially if you have children. Tl;dr they make the case that Haidt cherry picks data, has an agenda against social media, but doesn’t actually care about the well being of teens, and uses the fact we all come in with the bias that constant social media usage is probably not great for kids — but doesn’t do the research to back up his case.

♟️I’ve started playing chess again. I love playing on chess.com’s app, they make it super easy to learn the game and play some quick matches. If you play, let me know your handle!

Comments are closed.