This is a review of my 2024 and a public sharing of 2025 goals.

At the end, I share why I do this and my process for reviewing the year.

To summarize: This helps me look back at what worked, what didn’t, and what I want to focus on in 2025. I have to pause, reflect, and be honest about where I’m at—and where I want to go.

Let’s jump into it.

🎩 2024 Recap

Remote Life OS

My 2024 goal:

Make $50,000 in 2024 on the side, with only one product, one offer, two channels, with better processes and no hiring.

I missed the goal by more than 50%.

I also wrote this in last year’s goal setting:

I’ve been at this juncture before. Product in the can, on the verge of “figuring out” this business. The biggest mistake I make at this point: I ignore the constraint. I focus too much on the routine (and having a “process”).

I had way more success here. I focused on executing, and just solving the problem in front of me.

For example, the common mistake here is investing time to build a channel before testing the offer. I could have spent 6 months building an audience on TikTok before testing the offer again.

It’s not that TikTok is not a good channel or the wrong channel, but this would be the wrong sequence.

If you don’t have an audience, just direct sell. You’ll learn 10x faster direct selling an offer than wasting months (or even a year) building an audience… only to STILL have to validate whether they’d buy your offer.

Every iteration of LARJ taught me something new. Key milestones:

-

Create a compelling offer. A compelling offer is clearly defined, promises a specific outcome, and reduces as much friction as possible. Learn the problems people face, then share how you’ll solve these problems, point by point.

-

Three cohorts completed. Each time the program improved, and each time I doubled the price.

-

Lean approach. I ran each cohort out of Notion, Zoom, and WhatsApp. I sold over LinkedIn and email messages, with a sales page I put on Notion. I didn’t even create a proper course until the end of the year, and still managed to sell about 10 units of just the course itself, without the cohort experience.

-

Why people buy. Customers buy for different reasons. Some want a process. Others want accountability. Others need a sounding board. You don’t need to be all things to all customers to give them great value or get them results.

Family

Last year I wrote:

The best thing you can do for your family is to give them the best version of yourself.

There’s a corollary to this that I’m starting to wrap my head around:

The next best thing? Help them be the best version of themselves.

Here’s an example: sometimes the kids want pancakes on a school day. If they ask me, there’s no way it’s happening. I’m trying to shovel eggs into my face while carrying a baby and packing 3 lunches.

Ain’t nobody got time for pancakes.

Amy’s response?

Buttermilk or chocolate chip? How about both?

For years, I thought the path to becoming a better dad was to make the damn pancakes.

But as Amy worked the griddle, and I cleared the dish rack, changed Theodore’s diaper, and packed the kid’s school bags, it dawned on me:

I don’t need to be the parent that makes the pancakes.

I can be the parent that makes the time and space so someone else can make the pancakes.

In other words: sometimes the best way to be a great father is to be a great husband.

Other family highlights:

-

Theodore. And a six-month paternity leave to spend with him. You can read his birthday letter here.

-

Oliver and Annabel. Watching them continue to grow closer together as siblings

-

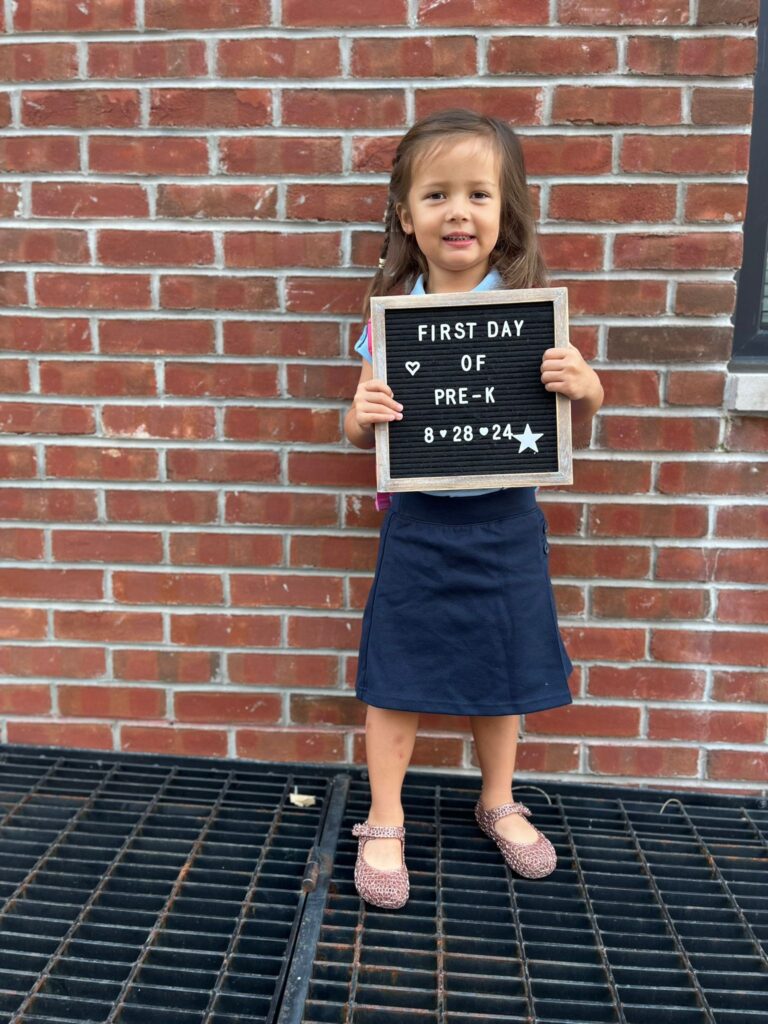

Culture over rules. Culture is what a group of people do and don’t do. That’s how we’ve framed our expectations for the kids: this is how we behave in this family. Last week, Annabel reminded an adult to take off their shoes in our apartment. Something is sticking.

-

More tools in the toolbox. This means more ways to be a better parent. Which makes parenting easier, and more fun.

-

3 family weddings this year. I love weddings.

-

We spent the summer in Ireland. And spent a lot of time with family in Dublin and Cork.

-

Work-life balance works both ways. WLB can mean canceling the afternoon because Theodore came home sick with a fever. It can also mean working weekends. WLB cuts both ways. That’s OK.

-

Always be investing in family relationships. You never get to stop investing in family. The corollary: Investment works both ways. Invest back into the people who invest in you.

Friends & Network

In 2024, I said I wanted to deepen existing relationships with standing lunches, catch-up calls, and standing weekend hangouts.

I did OK on this in the first half of the year. It was less of a focus in the back half after Theodore was born and we went to Ireland for the summer.

My good friend, Chris, passed in a motorcycle accident before Thanksgiving this year. We moved to Los Angeles together. We got our first apartment together, waited tables together, got started in Hollywood together. I always thought we’d have the chance to run it back down memory lane. Now he’s gone.

These things are the reminder you need: life is short. Make time for friends.

Career

At Persefoni, I built one of the first free carbon accounting tools. Any person or business could create an account and calculate their carbon footprint, even if they didn’t know anything about carbon emissions. I loved being deep in the trenches in climate tech, and working on this with smart, passionate people. I came into the industry with zero knowledge and learned a lot.

I phoned in the first half of the year, though. My motivation was low. One part because I was looking forward to paternity leave, one part internal factors at the company. I checked the box but my heart was into it.

Coming out of paternity leave, I started interviewing for my next role. Then realized now was the time to build under my name. More on that below.

Health

In 2024 I fixed my hip and glute pain. The root cause was my feet. Getting better shoes, getting insoles, and regular stretching did the trick.

I continued to train BJJ and weight train. I always find my way back to consistency, after Theodore, an injury that kept me out of training for 3 months, and extended travel. Without working out with a trainer, I still struggle with intensity.

Money

I used to work with a financial advisor. There was an exercise where we had to list out dream assets. Top of my list: get a minivan. #dreambig We bought our minivan in 2024. It feels like a luxury every long drive we take.

We’re back to a 25/25/50 savings, investing, and spending rate.

I switched from Kubera to a Monarch for day-to-day and net worth tracking. I’m loving the app.

Leisure/Travel

We spent the summer in Ireland. Saw the Taylor Swift Eras tour and the All Ireland semi-final in Croke Park. Oliver got really into soccer, and we saw old friends.

I went to Vegas for my cousin’s bachelor party.

I wanted to take trips to Budapest and Nashville, neither of which happened this year.

🗺️ 2025 Planning

My 2025 theme:

Take risks under your name.

h/t Naval Ravikant

Summary:

Grow RLOS to $100K business. Build a pipeline for consulting. Invest in family. Build community. Consistency in health. Downpayment banked for a house. Organize our business finances.

Remote Life OS

I’m moving RLOS off the back burner. It’s on the main. It’s time to give this an honest go.

The revenue goal is $100,000. I think I’ve said this in past updates, but it feels simultaneously ambitious and sandbagging. Time will tell which.

The core of Remote Life OS will revolve around my cohort-based course, the Land A Remote Job (LARJ) program. I’ll launch three 30-day sprints. I’ll continue to offer a coaching and self-paced tier.

Consulting

Consulting has been a part of my career portfolio since 2021. I help experts build million-dollar courses.

This year’s challenge: balancing RLOS with consulting. I want RLOS to be the main focus. Consulting is just a hedge, a way to make my monthly nut while I’m building RLOS.

I think I could make the math work so I could focus ONLY on RLOS, but I’m naturally risk-averse and that’s only increased with each car seat in my minivan.

But it doesn’t always work that way.

My ideal: I’d consult for 15-20 hours per week, and have enough pipeline where I’m not chasing work. That’s enough to replace my w2 income. Then I can spend the rest of my time on RLOS.

Family

I want to be involved with the kids’ extracurriculars: this will probably take the shape of coaching BJJ or soccer for them.

I want to continue investing in family, scheduling it ahead of time so that it happens. That includes more date nights with Amy.

I’m going to take more pictures.

Finally, I also want to be less petty. Earlier, I said:

Invest in those who invest in you.

The corollary to that is:

Take in that data. Be realistic. But don’t be petty. Pettiness is poison. Life is too short.

Friends & Network

Keep building relationships here in Philadelphia. Re-start soft networking in a sustainable way. Pro tip: upgrading my Calendly account and having different calendars for catch-ups, work, etc. makes this really easy.

Stretch goal: host work and networking events in Philly.

Health

Focus on consistency: BJJ 2x per week, weight train 3x per week. Start incorporating cardio, not sure how yet.

I’m not going to worry about intensity. I’m not going to compete in any tournaments.

Money

I want to have enough saved for a house downpayment this year. I’m estimating a purchase price of $800,000, which means $160,000 down.

I’ll sell my crypto holdings and keep up automatic investments to get there.

I also need to get Amy’s and my business finances in order, for tax and investment efficiencies.

Leisure/Travel

-

Spring: Visit my brother and his wife when they have their first baby. Celebrate Theodore’s first birthday. Host a karaoke party for my birthday.

-

Summer: Oliver’s birthday, wedding in Denver, maybe a trip to Dublin, family trip to the Poconos

-

Autumn: Annabel’s birthday, Nashville trip

-

Misc: keep playing chess, reading, watching movies

🛝 Fun Stuff

I watched 38 movies this year, same as last year.

Random standouts: Wicked, It’s What’s Inside, The Substance, Dune 2, Hit Man, Snack Shack, My Old Ass.

Wicked and Dune 2 I loved the most.

It’s What’s Inside and Snack Shack were surprise hits.

I read 18 books this year. Last year I read 14.

Some gems in no particular order: Demon Copperhead, Dune, Chain Gang All Stars, Service, The Poisonwood Bible, Later, Presumed Innocent.

🤔 Why do this at all?

Why document it? Two reasons

First, the Bill Gates quote sums it up:

“Most people overestimate what they can do in one year and underestimate what they can do in ten years.”

We’re capable of great things. They just take time.

Second, Having joy, treating things joyfully in what’s considered mundane.

Chris Bailey wrote:

To gain greater enjoyment from your experiences, try practicing anticipation and reminiscence. Both are forms of savoring—ways to convert positive experiences into positive emotions

We can also savor an experience after it happens—a savoring style called reminiscence. We reminisce by reliving an experience in our mind, looking back through photos of an experience, or talking about it with a friend or a loved one.

In other words: there’s joy in looking back.

⏪️ How I Review My Year

My process:

1. Review and retrospective on the last year.

I review:

-

Photos

-

Google photos

-

Swarm check-ins

-

Instagram

-

Google Calendar

Then, I review my notes on Roam. I put these in six buckets: Long-term projects, Career, Relationships, Health, Finances, and Leisure. For each bucket, I think about: (1) What went well (2) What could be improved.

2. Plan the next year.

I review notes about (1) my long-term goals and (2) my Perfect Tuesday. These are my North Star metrics as I plan what I want to accomplish in the new year. (I cover long-term goals, including specific $ I plan to earn, here.)

Finally, I keep the following in mind:

“Plans are worthless, but planning is everything.” – Dwight D. Eisenhower

Success is measured by inputs and intention, not blindly following a set path.

Here are my reviews of 2023, 2022, 2021, 2018, 2017

How was your year? If you did an annual review, LMK. I’d love to read it.